Capital gain formula real estate

Net Proceeds Cost Basis Total Capital Gain 500000 Net Proceeds 295000 Cost Basis 205000 Total Capital Gain The investor will then be responsible. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning.

Capital Gains Yield Cgy Formula Calculation Example And Guide

Due to new fiscal cliff legislation capital gains dividend tax rates are increasing from 15 to 20 for singles earning over 400000 and couples earnings over 450000.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. What FIRPTA is and How it Works. Once you have this information you can calculate your capital gain or loss with the following formula. Real Estate Gains When you sell a property in Texas the profits or capital gains on that property equal the selling price of the property minus the original price that you paid for.

FIRPTA imposes a tax on capital gains derived by foreign people from the disposition of US. Capital gain calculation in four steps Determine your basis. See what funds are currently on the Marketplace.

Find Fresh Content Updated Daily For How to figure capital gains tax. If you meet the requirements youre allowed to make up to 250000 for single taxpayers or 500000 for joint filers on the sale of your home and not have to pay any capital gains tax on. The formula for calculating your capital gain is your gross proceeds minus your adjusted basis minus any primary residence exclusion for which you qualify.

The IRS typically allows you to exclude up to. If this amount is higher than your annual. Ad More than 3 billion invested over 500 funded deals on the CrowdStreet Marketplace.

Gain Financial Freedom Today. Tax Paid on Capital Gain from Real Estate. Using the numbers in this.

Ad Learn Alternate Retirement Strategies How To Achieve Financial Freedom With Tresa Todd. The formula for calculating a return on capital gains can be expressed as follows. Register Online For Our Next Masterclass Starting Sept 11.

Capital Gain Sale Price of Asset Adjusted Basis Selling Expenses For example. The capital gains tax formula is calculated by subtracting your original purchase price from your sale price and then dividing that amount by two. Schedule your no cost no obligation coaching strategy session today.

Lets say you bought a house in San Diego for 600000 and then sold it for 800000. Short Term Capital Gain Final Sale Price. 250000 of capital gains on real estate if youre single.

Capital gain Base price of investment x 100 The return is expressed as a percentage to. Capital Gain Sale Price of Asset - Purchase Price of Asset - Selling Costs If you. New deals go live every week.

Ad Let us help maximize your leads increase sales and leverage your resources. Basis may also be increased by reinvested dividends on. This is generally the purchase price plus any commissions or fees paid.

500000 of capital gains on real estate if youre married and filing jointly. Formula for Calculation of Short Term Capital Gains In order to calculate short term capital gains the computation is as below. Calculating capital gains tax on real estate in India.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

3 Ways To Calculate Capital Gains Wikihow

3 Ways To Calculate Capital Gains Wikihow

3 Ways To Calculate Capital Gains Wikihow

Flipping Houses Taxes Capital Gains Vs Ordinary Income

Capitalization Rate Formula Calculator Excel Template

Capital Gains Tax What Is It When Do You Pay It

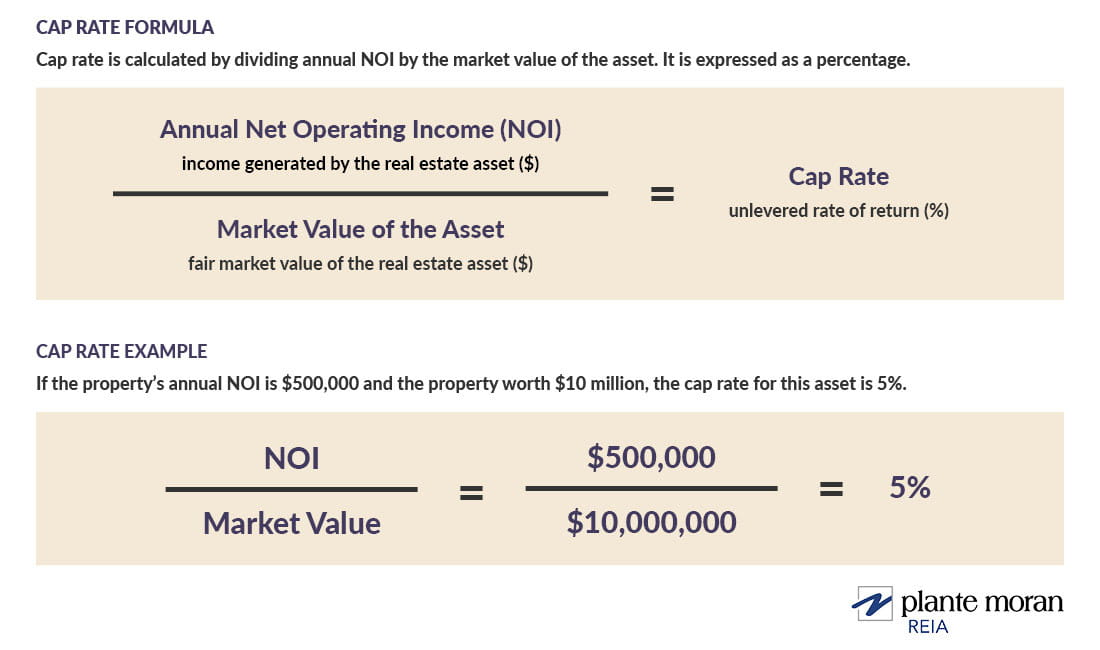

Return Metrics Explained What Is A Cap Rate In Commercial Real Estate Our Insights Plante Moran

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How To Calculate Capital Gains Tax H R Block

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

How To Save Capital Gain Tax On Sale Of Residential Property

3 Ways To Calculate Capital Gains Wikihow

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Tax What Is It When Do You Pay It

Capital Appreciation Meaning Example How To Calculate